New Delhi: In light of India's decelerating economic growth, HSBC Global Research has revised its outlook for the Indian stock market from "overweight" to "neutral."

The global financial services firm noted in its report that corporate profits in India seem to have weakened, while market valuations remain high.

Following a period of annualized growth of 25 percent in recent years, profits have shown signs of decline, with valuations currently at 23 times forward earnings.

"As earnings fall short of expectations—leading to a reduction in consensus FY25 growth projections for the NIFTY 50 from 15 percent to 5 percent—investors are likely to reassess their strategies, which may restrict market returns," the report stated while adjusting India's rating to "neutral."

The Nifty index, a key benchmark for the Indian stock market, is presently approximately 11 percent below its peak of 26,277.35 points. In 2024, both the Sensex and Nifty indices recorded growth of around 9-10 percent each, while in 2023, they achieved gains of 16-17 percent cumulatively. In contrast, 2022 saw a modest increase of just 3 percent for both indices.

Challenges such as sluggish GDP growth, outflows of foreign funds, rising food prices, and subdued consumer spending have deterred many investors in 2024.

The HSBC Global Research report, however, maintains an overweight position on mainland China, Hong Kong, and Indonesia, while adopting an underweight stance on Taiwan, Japan, Singapore, and Thailand.

In financial terminology, an overweight rating indicates that an analyst or advisory firm anticipates a stock's price will outperform in the future, and the opposite applies for an underweight rating.

The assessment indicates an improved risk profile for mainland China equities, projecting a 21 percent increase for the Hang Seng China Enterprises Index (HSCEI) by the end of 2025. This anticipated growth, coupled with potentially lower US bond yields, is expected to positively impact Hong Kong stocks, prompting an upgrade of the market to an overweight position, according to the report on China.

In Japan, equities have gained from a depreciating yen in 2024. However, the HSBC Global Research report suggests that there is limited potential for this trend to persist into 2025, which may constrain overall performance.

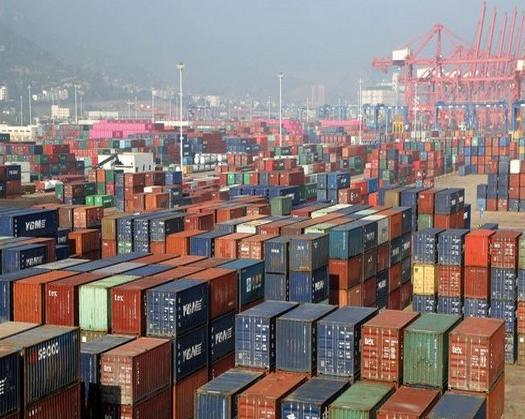

The ASEAN region is increasingly becoming a focal point for global supply chains, with a rise in data center clusters. With anticipated interest rate cuts, HSBC Global Research predicts that investors will likely gravitate towards ASEAN markets this year.