New Delhi: Non-Resident Indians (NRIs) are increasingly turning to India to acquire term insurance policies, with purchases more than doubling in the last two years, according to a Policybazaar research report.

According to the data in the study, NRI term insurance purchases from India increased by 100% between fiscal year 22 and 26 year-to-date (YTD).

The report also highlights competitive premiums, long-term policy alternatives, and rupee-denominated benefits that protect families and assets back home as important drivers of this trend.

According to the statement, NRIs are increasingly turning to India's term insurance solutions to safeguard their families and financial responsibilities back home.

Many NRIs have financial obligations in India, including as dependents, house loans, and investments, making India-linked insurance a popular option.

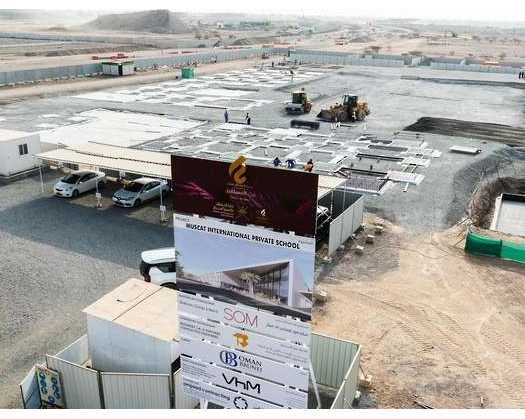

Nearly six out of ten NRI term insurance policies are purchased in the UAE and Gulf Cooperation Council (GCC).

Data indicated that this area accounted for 59% of all NRI term life insurance policies issued from FY22 to FY26 YTD.

The majority of these purchasers are salaried professionals and company owners in industries such as building, retail, and services. Indiabased insurers are appealing to Gulf-based NRIs because to their reduced rates and rupee-settled rewards.

Indialinked term life insurance has also grown rapidly in Europe and Australia-New Zealand, with a combined compound annual growth rate (CAGR) of 87% between FY22 and FY26 YTD.

This rise is mostly fueled by tech specialists and long-term permanent inhabitants who want Indiabased protection programs.

According to the research, women are increasingly becoming a significant category of NRI term purchasers. Female involvement is currently at 15%, with greater adoption in the UAE and North America.

Almost 80% of NRI buyers prefer monthly premium payment arrangements, making them the most common option. However, single-premium plans have grown in popularity, particularly in the UAE, where some consumers choose to lock in 3040 years of coverage at once.

According to the study, India's insurance sector is gaining appeal among NRIs.