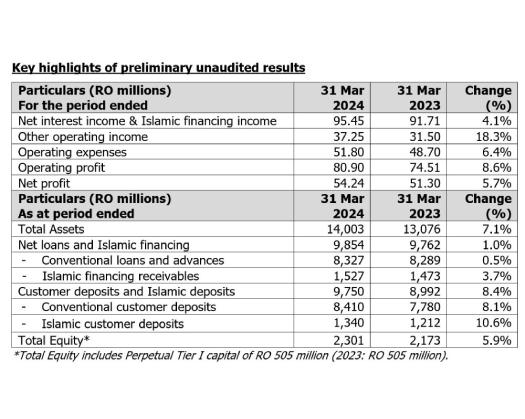

Bank Muscat, the leading financial institution in Oman, has released its preliminary unaudited financial results for the first quarter of 2024. The bank recorded a net profit of RO 54.24 million for the period, showing a 5.7% increase from the RO 51.30 million reported in the same period in 2023.

Key highlights of the results include:

1) Net interest income from conventional banking and net income from Islamic financing totaled RO 95.45 million for the first quarter of 2024, up from RO 91.71 million in the same period last year, marking a 4.1% increase.

2) Non-interest income reached RO 37.25 million for the first quarter of 2024, compared to RO 31.50 million in the same period in 2023, showing an 18.3% increase attributed to improvements in various business lines and increased volume.

3) Operating expenses for the first quarter of 2024 amounted to RO 51.80 million, up from RO 48.70 million in the same period last year, representing a 6.4% increase.

4) Net impairment for credit losses for the first quarter of 2024 was RO 16.13 million, compared to RO 14.44 million in the same period in 2023.

5) Net loans and advances, including Islamic financing receivables, rose by 1.0% to RO 9,854 million as of March 31, 2024, from RO 9,762 million as of March 31, 2023.

6) Customer deposits, which also include Islamic customer deposits, rose by 8.4% to reach RO 9,750 million compared to RO 8,992 million as of March 31, 2023.

The Bank's Board of Directors is set to approve the release of the full results for the first quarter of 2024, along with the unaudited financial statements, in April 2024 after their upcoming meeting.