Oman, an Arab nation with its capital Muscat, is situated at the southeastern extremity of the Arabian Peninsula. It shares its borders with five countries: Yemen, Iran, Saudi Arabia, Pakistan, and the United Arab Emirates. For many years, Oman has been a favored destination for foreign investors, thanks to its monarchy-based government that fosters business and commerce. The nation has been on a path of continuous development, with projections indicating a 10% increase in economic growth by 2040. As of now, Oman's population stands at 4.7 million. In 2018, the World Bank placed Oman at 71st position in terms of ease of doing business globally, according to the World Bank's rankings.

Are you considering establishing the foundation of your business in Oman? If so, you are on the right path. At this juncture, it is imperative to understand the reasons that make Oman a premier destination for investment. Below are several key factors to consider.

1. Comprehensive Facilities

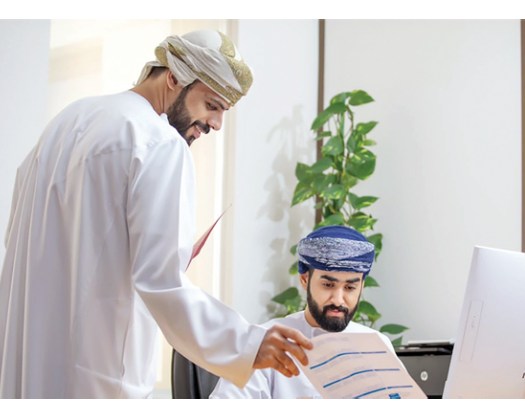

The Ministry of Foreign Affairs and Commerce of Oman has undertaken significant steps towards developing a robust infrastructure, enhancing commercial connectivity, ensuring high security, protecting property rights, and fostering international networking. These initiatives have created an environment that is conducive for entrepreneurs to seize investment opportunities, transform business concepts, and contribute to the economic growth of the nation.

2. Oman's Ninth Five-Year Development Plan

This strategic plan places a strong emphasis on the completion of projects through Public-Private Partnerships. The Vision 2020 objective is to cultivate a robust economy for the future by focusing on the development of business incorporation, human resources, economic diversification, and the growth of the private sector.

3. Support for Start-ups and Entrepreneurship

The Omani government is committed to the development of a smart city. Through robust international networking and trade agreements, Oman has broadened the scope of foreign investment, benefiting both small and medium enterprises and start-ups within the country. Additionally, the government is investing in the establishment of the first oil and gas institute to cultivate professionals in the energy sector.

4. Taxation Policies

Oman is recognized as a tax-free zone, meaning that there are no personal income or individual tax obligations. Upon establishment, a company is subject to a flat 15% corporate tax rate. Furthermore, goods crossing the Gulf Cooperation Council (GCC) are exempt from customs duties. The overall taxation framework has played a pivotal role in attracting investment opportunities within the Omani market.

5. Company Formation and Ownership Rights

Omani Law recognizes three primary formats for company formation: Limited Liability Company (LLC), Closed Joint Stock Company, and Open Joint Stock Company. Among these, the LLC is the most prevalent type of company established in Oman. In certain instances, ownership by foreign investors can extend up to 100%.

6. Expansion of Non-Oil Product Exports

The government is actively pursuing initiatives to expand the export of non-oil products, thereby creating significant opportunities for sectors such as fishing, manufacturing, pharmaceuticals, mineral mining, among others. According to Oman's business news, there was a 28% increase in exports during the 2017-2018 period.

7. Oman's Vision 2040

Oman's oil and gas sector is considered the cornerstone of the nation's economy. In addition to this, the government has initiated several measures to develop various sectors including infrastructure, tourism, technology, hospitality, transportation, manufacturing, mining, and the perfume industry. The city of Muscat is envisioned to serve as a bridge connecting Asia and Africa, with projections of an increase in investments by 31 billion riyals by 2040, marking a substantial growth.

8. Oman Projects

The nation has been actively involved in the completion of various projects across different sectors, aimed at enhancing the welfare of the economy. Among the ongoing initiatives are the Salalah LPG Project, the Mina Sultan Qaboos Waterfront Project, and the expansion of Muscat International Airport. These projects are poised to contribute significantly to the growth and development of Oman's economy.

Therefore, it is evident that Oman serves as an ideal platform for establishing new businesses. The government is supportive of investors, both domestic and international, in contributing to the global economy. Business Setup Worldwide is dedicated to facilitating the establishment of businesses in Oman. We provide comprehensive support services, including company registration, accounting and bookkeeping, tax advisory, and intellectual property protection. For further information, please do not hesitate to contact us. We are eager to assist you and be a part of your journey towards success.

FAQs

1. What are the different legal entities in Oman?

- Sole proprietorship

- General Partnership

- Limited Partnership

- Joint Venture Company

- Joint Stock Company

- Holding Company

- Branch Office

- Representative Office

2. Which is the company registration authority in Oman?

- The Oman Chamber of Commerce and Industry (OCCI).

3. What are the free zones in Oman?

- Sohar Free zone

- The Southern port of Salalah

- Duqm Special Economic Zone

- Al Mazunah Free Zone

4. What is the minimum share capital of company registration in Oman?

- OMR150, 000.

For Business Setup related inquires get in touch with Innovative Digital and Business LLC and get 24/7 assistance for Company Registration in Oman.

Email: info@innovativedigital.om

Landline: +968 2411 1861 | WhatsApp: +968 7110 6867