Mumbai: In light of the prevailing economic uncertainties, the Reserve Bank of India (RBI) has opted to maintain the repo rate at 6.5 percent, marking its ninth consecutive decision to uphold stability in its monetary policy.

Governor Das elucidated, "Following a comprehensive evaluation of the evolving macroeconomic and financial landscape, as well as the overall economic outlook, it was unanimously decided by the majority of four members to retain the policy repo rate at 6.5 percent."

He further elaborated, "The standing deposit facility rate has been set at 6.25 percent, alongside the marginal standing facility rate and the bank rate at 6.75 percent. Furthermore, the Monetary Policy Committee (MPC), with a majority consensus of four out of six members, has chosen to persist in its strategy of gradually withdrawing accommodation to ensure that inflation moves in a direction that is progressively aligned with the target, while concurrently fostering economic growth."

This decision to maintain the repo rate is made against the backdrop of persistent concerns regarding inflation, which continues to exceed the RBI's target range. The central bank's dedication to achieving the inflation target of 4 percent remains challenged by ongoing food inflation and other economic factors.

Governor Das underscored the RBI's vigilance towards inflationary pressures, pledging to implement necessary measures to ensure price stability while supporting the nation's economic recovery. The decision by the MPC is indicative of a balanced strategy, aimed at controlling inflation without impeding economic growth.

He cautioned against complacency, noting a significant decline in core inflation due to the slowdown in the disinflation process in the first quarter, attributed to ongoing food price shocks.

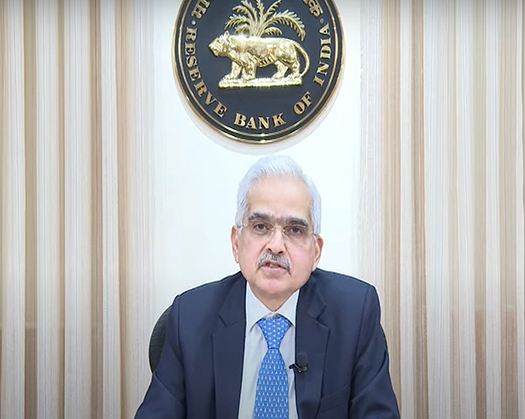

The announcement was made by RBI Governor Shaktikanta Das during a press briefing on Thursday, following the conclusion of a three-day meeting of the Monetary Policy Committee (MPC). The decision was reached after a thorough analysis of the current macroeconomic and financial conditions, as well as future economic forecasts.