The digital economy in the GCC region has been rapidly expanding, driven by government efforts, regulatory backing, and the growing popularity of digital transactions. Fintech companies are playing a crucial role in this evolution by introducing cutting-edge technologies that are making digital commerce more accessible to both individuals and businesses. Thanks to fintech, consumers now have access to convenient and personalized financial services, while businesses can tap into a wider array of financial solutions. Ultimately, the economy stands to gain from greater financial inclusion and enhanced innovation facilitated by fintech advancements.

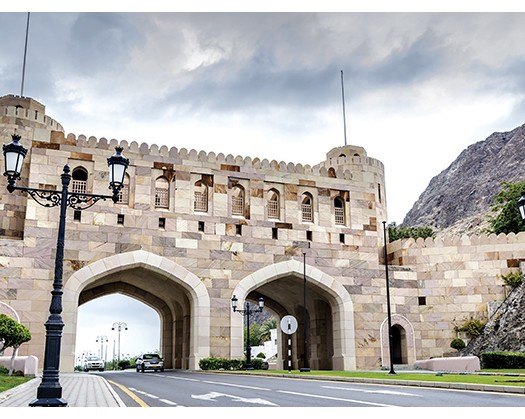

Governments have been leading the way in driving this transformation. In Oman, the Central Bank of Oman has adopted a proactive approach by implementing a regulatory sandbox, enabling fintech companies to test their innovative technology-based solutions in a controlled setting. The Oman Startup Hub (OSH) serves as a platform for startups, investors, advisors, and entrepreneurs to engage and gain insights into the innovation ecosystem in the Sultanate. Additionally, the Oman Technology Fund “OTF” is dedicated to positioning Oman as a key player in the realm of knowledge leadership in the Middle East.

Oman's initiatives have paved the way for fintech companies like Thawani, which offers mobile payment solutions to both merchants and consumers, to revolutionize the fintech landscape in Oman and the wider region.

The rise of cutting-edge technologies such as AI and Blockchain, integral components of the Web3 revolution, presents a significant opportunity - AI alone, for example, has the potential to generate up to $150 billion in tangible value in the GCC. The Omani government is actively developing a legal and regulatory framework that supports AI innovation while ensuring the ethical use of AI. Moreover, the Information Technology Authority of Oman is formulating a national strategy for AI, outlining the country's vision and roadmap for the implementation of AI across various sectors.

However, fintech companies are still confronted with obstacles that have the potential to impede their growth and restrict the value they can provide to individuals and economies. Our recent study has identified emerging patterns that the broader ecosystem needs to address in order to maximize the potential that fintechs can offer to consumers, businesses, and the overall economy.

One significant challenge is the global competition for technology talent. The high demand for skilled professionals, combined with the relatively high cost of living, can make talent acquisition expensive, which may hinder the growth of fintechs. In Oman, the government is making investments in technology education to ensure a steady supply of tech talent, and the OSH is fostering the growth of tech startups and attracting international technology talent. These hubs create an environment that is conducive to innovation and entrepreneurship.

Another trend shaping the fintech landscape is the access to underlying payment systems that were previously exclusive to banks and exchange houses. This access opens up multiple revenue streams for fintechs, including fees, float, foreign exchange, and data. As a result, payments have become a major focus for many fintechs, with telecom companies introducing large digital wallets. The market is witnessing a wide range of offerings, such as BNPL solutions, personal finance, and virtual assets, which has ushered in a new era of financial innovation.

The unique challenges faced by fintech operations with cross-border operations in the MENA region require careful navigation of country-specific licensing and regulations. This presents an opportunity for regulatory bodies in the region to collaborate with ecosystem stakeholders to address these challenges effectively.

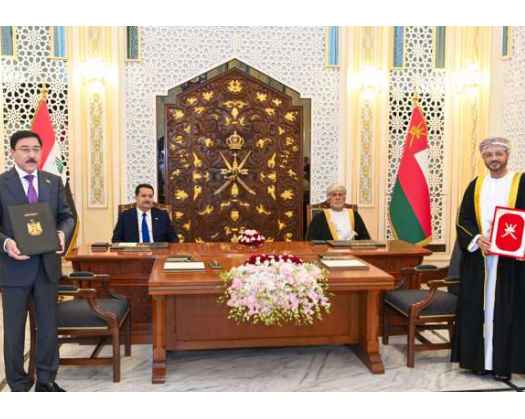

There is a growing trend of fintech companies seeking mentorship, infrastructure support, and investment from industry players. This underscores the importance of private sector involvement in creating a conducive ecosystem for fintech growth, complementing government efforts. Visa, for example, has been actively supporting fintechs in Oman through various programs, including the 2024 Visa Everywhere Initiative (VEI) in Saudi Arabia, Oman, and Bahrain. This initiative provides fintech startups with a platform to showcase their solutions globally and secure funding for their development and operational needs.

Fintechs in Oman have the potential to deliver significant social benefits by expanding access to financial services and supporting businesses in their digital transformation. It is crucial to support the growth of fintech companies to realize this potential. Collaboration and cooperation will be key to unlocking a promising future for all stakeholders involved.