Muscat: On Tuesday, exchange houses in Oman were offering INR219 per Omani Rial, marking a significant milestone as the Indian Rupee reached its highest exchange rate in history.

As of Tuesday afternoon, the value of a single Omani Rial was pegged at INR219.05 by exchange houses in Oman. There are indications that the Indian Rupee is poised to decline further in the coming days, a development that is undoubtedly beneficial for Indian nationals residing in Oman who are seeking to remit funds to their loved ones abroad.

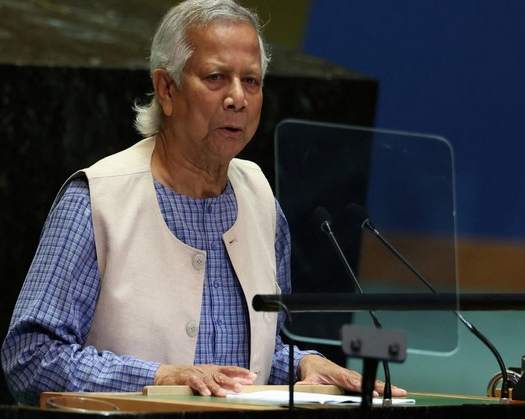

"The volume of transactions has certainly seen an increase over the past few days," stated Iftekhar Ul Hasan Chowdhury, CEO of Gulf Overseas Exchange, which was offering rates of INR219.05 per Omani Rial. "Individuals who had been holding onto their funds are now taking advantage of these unprecedentedly high rates to send money back home. We anticipate that it may even reach INR220."

The Indian Rupee has been on a downward trend over the past few months.

At the time of this report, the rupee was trading at 84.41 against the US dollar, very close to its record low of 84.48, as economic and geopolitical factors continue to exert pressure on the currency.

This level, indicative of persistent challenges faced by the rupee, underscores the ongoing struggle against strong US dollar demand, escalating crude oil prices, and significant foreign institutional outflows.

Ajay Kedia, Director of Kedia Advisory, underscored the rupee's recent decline over the past few months, noting its recent record low of 84.48 against the US dollar. He attributed this pressure to substantial foreign institutional outflows, rising crude oil costs, and increased demand for the US dollar, compounded by geopolitical tensions and expectations for a more restrictive US monetary policy.

He added that the Reserve Bank of India (RBI) has been actively engaged in managing volatility, which has provided some stability. However, the rupee is expected to remain within a range of 84.05-84.70 in the near term.

He identified a key support level at 83.90 and a resistance level at 84.70.

Jateen Trivedi, Vice President and Research Analyst for Commodities and Currency at LKP Securities, observed that the rupee has traded relatively flat near 84.41, as the US dollar index remained neutral with minimal foreign institutional selling at the start of the week. A stronger US dollar has intensified the pressure on emerging market currencies, including the Indian Rupee.

Despite these challenges, the Indian Rupee has experienced significant depreciation in recent months, as tightening US monetary policy, global volatility, and geopolitical events have posed challenges to emerging market currencies.

Although the RBI has taken steps to stabilize the currency, there is a belief that further measures may be necessary should the US dollar rally persist.

It is also noteworthy that the depreciation of the Indian Rupee in comparison to that of developed nation currencies such as the Euro, pound sterling, or Chinese Yuan is relatively less.