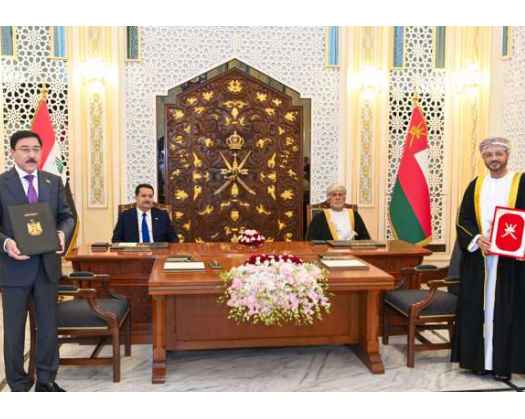

New Delhi: In a significant reform designed to offer relief to households, farmers, businesses, and the healthcare sector, Finance Minister Nirmala Sitharaman announced on Wednesday a comprehensive reduction in Goods and Services Tax (GST) rates for a broad array of essential items, vehicles, agricultural inputs, and electronic devices. Dubbed the "Next-Gen GST Reform," this initiative is presented as a historic Diwali gift to the nation and is anticipated to alleviate living costs while stimulating economic activity.

The 56th GST council meeting resolved to streamline GST rates into two categories of 5 percent and 18 percent by consolidating the 12 percent and 28 percent rates.

GST rates on everyday essential items such as hair oil, shampoo, toothpaste, toilet soap bars, toothbrushes, and shaving cream have been reduced from 18 percent to a mere 5 percent. Likewise, products like butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, and mixtures, as well as utensils, feeding bottles, baby napkins, clinical diapers, and sewing machines will now incur only a 5 percent GST instead of the previous 12 percent.

To enhance the affordability of healthcare, the GST Council has exempted individual health and life insurance policies from GST, reducing their rate from 18 percent to zero. Additionally, items such as thermometers, medical-grade oxygen, diagnostic kits, reagents, glucometers, test strips, and corrective spectacles have also had their GST rates lowered to 5 percent, thereby relieving some of the financial pressure on patients and healthcare providers.

The government has prioritized providing relief to farmers and the agricultural sector. Tractor tires, tractor components, and designated agricultural machinery for soil preparation, cultivation, harvesting, and threshing will now be subject to a 5 percent GST, down from the previous rates of 18 percent or 12 percent. Additionally, drip irrigation systems, sprinklers, bio-pesticides, and micronutrients have also been included in the 5 percent category, which will lower input costs for farmers.

Automobiles have become more affordable, as GST rates for petrol, LPG, and CNG hybrid cars (up to 1200 cc and 4000 mm) have been reduced from 28 percent to 18 percent. Diesel hybrid cars (up to 1500 cc and 4000 mm), three-wheelers, motorcycles (350 cc and below), and goods transport vehicles will now also incur an 18 percent GST instead of the previous 28 percent.

The GST council has extended relief to the education sector as well. GST on maps, charts, globes, pencils, sharpeners, crayons, pastels, exercise books, notebooks, and erasers has been entirely eliminated, rendering them tax-free.

Electronic appliances such as air conditioners, televisions, monitors, projectors, and dishwashers will now be subject to an 18 percent GST, reduced from 28 percent.

Prime Minister Narendra Modi has stated that the new GST rates are designed to benefit every Indian.

"Taxes for the general public will be significantly reduced. Our MSMEs and small entrepreneurs will reap substantial benefits. Everyday items will become more affordable, which will stimulate the economy," he remarked.

The government has also implemented process reforms, including automatic registration within three working days and expedited refunds through system-based risk assessment.

The net revenue impact from the rationalization of GST rates will amount to Rs 48,000 crore for the government.