Mumbai: On Thursday, Indian stock markets rebounded after a sluggish start in the morning. By mid-session, the markets had risen approximately 1 percent, driven by a robust domestic narrative and foreign portfolio investor (FPI) buying.

The Nifty index increased by over 250 points, reaching 23,707.45, which is a rise of 1.15 percent, after initially opening down by 35.35 points or 0.15 percent. Similarly, the BSE Sensex climbed more than 950 points to hit 78,007.05, marking an increase of 950.76 points or 1.27 percent.

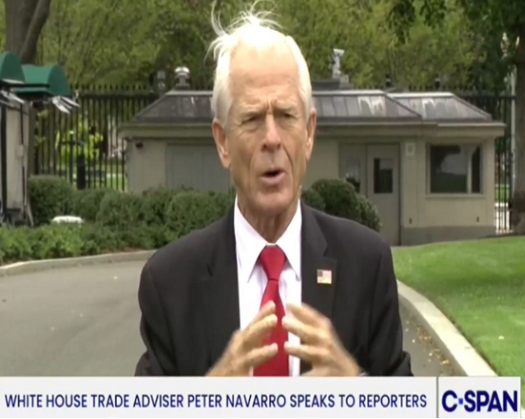

Ajay Bagga, a banking and market expert, stated to ANI, "India has shown resilience following the sell-off on April 2. The Indian markets are experiencing a positive re-rating due to a strong domestic narrative and the absence of external vulnerabilities. This week, FPIs have become net buyers, encouraged by the re-rating, the strengthening rupee, and the promising outlook for a resilient Indian corporate sector. The forecast of a normal to above-normal monsoon has bolstered the domestic consumption narrative. Additionally, monetary easing and the significant liquidity provided by the RBI are enhancing both financial conditions and market sentiment."

In terms of sector performance, all indices except Nifty IT saw gains. Nifty Banking stocks led the way, with the Private Bank index rising over 1.3 percent, while other sectors also exhibited signs of recovery.

Nifty IT managed to narrow its losses, decreasing by 0.95 percent at the time of this report, having initially dropped more than 2 percent at the opening.

Vijay Chopra, a market expert, informed ANI that the markets are currently experiencing a rally, driven by declining crude oil prices, a strengthening rupee, decreasing inflation, and favorable monsoon conditions. Bank stocks are particularly leading this upward trend, as strong deposit growth—likely a result of six months of market downturn—may pave the way for impressive earnings. Additionally, short sellers appear to be caught off guard due to Trump's pause and the upcoming long weekend.

Within the Nifty 50 index, notable gainers during this recovery include Bharti Airtel, Eternal, ICICI Bank, and Adani Ports, while the biggest losers are Wipro, Hero MotoCorp, Tech Mahindra, and Coal India.