New York: The International Longshoremen's Association (ILA), a labor union representing North American longshoremen, has recently issued a threat of a strike should a new agreement not be reached prior to the expiration of the current contract on September 30.

Experts are expressing concerns regarding the potential for a large-scale port strike, fearing its detrimental effects on the United States economy and the disruption it could cause to the global supply chain.

Media reports indicate that the ILA is pushing for substantial increases in wages within the forthcoming six-year agreement, arguing that inflation has eroded any previous wage gains and that wages over the last six years have been insufficient.

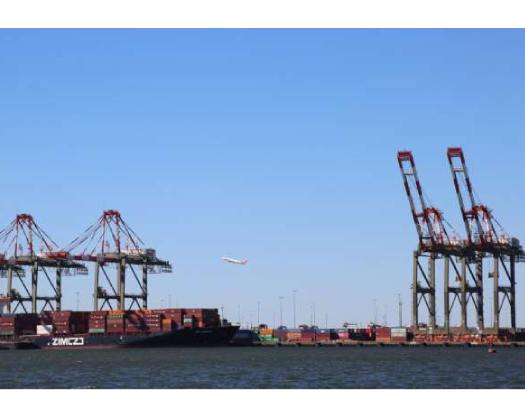

Furthermore, the ILA is calling for a complete prohibition on the automation of cranes, gates, and container handling equipment at over 30 U.S. ports.

As the deadline looms closer, there is a growing apprehension that a significant port strike in the United States may become a reality. This could mark the first major strike to occur along the East Coast and Gulf of Mexico ports since 1977.

It is estimated that approximately three-fifths of container shipments to the United States transit through the East and Gulf Coasts. Logistics experts have noted that it would be impractical for the West Coast ports to manage the entirety or a substantial portion of these shipments should they be redirected.

"Even a strike lasting two weeks could disrupt global supply chains until 2025," Grace Zwemmer, an associate U.S. economist with Oxford, cautioned in a recent report.

Transportation analysts at JPMorgan Chase have estimated that a strike could result in a daily economic loss of 5 billion U.S. dollars, equivalent to about 6 percent of the country's daily gross domestic product.

Should shippers opt for West Coast ports, there is a risk of congestion, which could lead to delays in cargo delivery and a significant increase in shipping costs.

In response to the escalating situation, several international shipping companies are readying themselves for a port shutdown along the East Coast.

Market sentiments regarding the potential breakdown in labor negotiations leading to further disruptions in the supply chain have contributed to a rise in the stock prices of shipping giant Maersk Group, which has seen a nearly 20 percent increase in value over the past fortnight.

Mike DeAngelis, the senior director of international solutions for freight visibility platform FourKites, believes that the potential port strike will only intensify the existing challenges.

"We are facing a perfect storm, with the Red Sea disruptions obstructing normal access to the Suez Canal, and the Panama Canal's reduced capacity, an ILA strike would effectively cut off major trade routes," DeAngelis stated.