Muscat: The 16th Annual Meeting of the International Forum of Sovereign Wealth Funds (IFSWF) concluded in Muscat, signifying the largest assembly in its history.

Hosted by the Sultanate of Oman, represented by the Oman Investment Authority, the event spanned from November 3 to 6 and achieved a record attendance, with over 300 participants from more than 46 countries. This included a distinguished head of state, ministers, and CEOs from over 50 sovereign wealth funds.

Fostering Stability and Prosperity

During the inaugural ceremony, presided over by His Highness Sayyid Theyazin bin Haitham Al Said, it was emphasized that Oman's selection as the host underscored the country's exemplary commitment to global governance standards, sustainability in wealth management, and proficiency in resource promotion and investment.

He reiterated Oman's dedication to maintaining stability and prosperity, welcoming international investments, and enhancing relations with sovereign wealth funds globally, with the aim of forging strategic partnerships that would benefit all parties involved.

Official Dinner for Attendees

In accordance with the directives of His Majesty Sultan Haitham bin Tarik, His Highness Sayyid Taimur bin Tariq Al Said, Chairman of the Board of Governors of the Central Bank of Oman, led an official dinner hosted by Oman Investment Authority on Sunday, November 3, at the Al Bustan Palace Hotel. This dinner was graced by senior officials, including ministers, high-ranking dignitaries, and representatives from Oman Investment Authority, in honor of the distinguished guests of the annual forum.

Enhancing Economic and Investment Cooperation

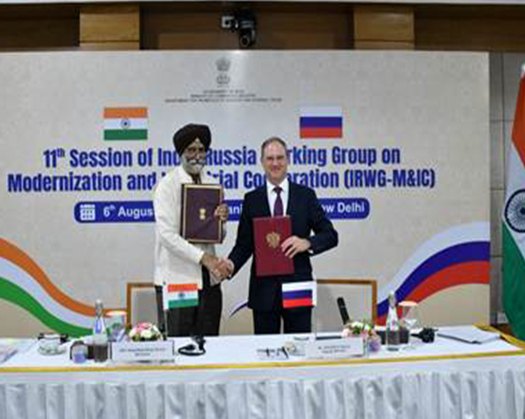

The annual assembly featured numerous side meetings dedicated to exploring investment cooperation and the signing of cooperation agreements.

His Excellency Abdulsalam Al-Murshidi, President of Oman Investment Authority, extended his warmest welcome to David Ranibok Adeang, President of the Republic of Nauru. During their dialogue, they discussed strategies to augment economic and investment collaboration between the two nations, exploring avenues for establishing strategic partnerships across various sectors. Furthermore, Abdulsalam Al-Murshidi signed a cooperation agreement with Ghanem Al Ghenaiman, Board Member and General Manager of the Kuwait Investment Authority.

This agreement is aimed at fortifying the investment partnership between Oman and Kuwait, leveraging their robust relations and shared ambition to foster economic growth and expand cooperation in areas of mutual benefit.

According to the agreement, the parties will commence discussions on the establishment of a joint venture in Oman, as well as explore investment opportunities in sectors overseen by Oman Investment Authority, including energy, utilities, social infrastructure, communications, transportation, and logistics services.

In acknowledgment of the profound discussions that transpired during the meeting, the members of the forum have collectively decided to elevate the stature of the associated conference, henceforth known as the 'Muscat Dialogue.'

This prestigious forum will adopt the name of the host city each year, thereby establishing a dynamic platform that fosters dialogue and collaboration on critical issues such as investment, sustainable development, and global economic challenges.

Aligned with National Priorities

The 2024 edition of the conference, in conjunction with the conference, featured an extensive array of panel discussions and meetings. These sessions were designed to address key investment topics that are in alignment with the national priorities outlined in the Oman Vision 2040.

The discussions spanned a variety of critical areas, including the energy transition, artificial intelligence, supply chain management, the evolving roles and responsibilities of sovereign wealth funds, and the emergence of multi-purpose funds.

Notable Highlights

A particularly distinguished highlight was a conversation with Elon Musk, covering topics such as artificial intelligence, space technology, alternative energy, investment opportunities in artificial intelligence, navigating a dynamic policy environment, and the impact of the energy transition on the investment landscape in developing economies.

The forum also delved into the increasing significance of governance within sovereign wealth funds and their societal impact.

Oman's Perspective in the Muscat Dialogue

Throughout the International Forum for Sustainable Wealth Fund Management (IFSWWF) event, the Oman Investment Authority underscored the Omani perspective. The event was graced by 15 speakers from both the public and private sectors, representing various sectors including economy, development, energy, logistics, innovation, and artificial intelligence. These speakers offered insights and ideas that reflected Oman's ambitions for economic progress, highlighting the diverse investment opportunities available within the Sultanate. This, in turn, reinforces Oman's position as an attractive investment destination and a hub of opportunity.

The Inaugural Meeting of the International Sovereign Wealth Funds Forum Foundation (IFSWFF) is set to welcome a new Board of Directors in 2026, following the election of its members. Chairing this distinguished body will be Israfil Mammadov, CEO of the State Oil Fund of Azerbaijan, who will take over from Obaid Amrane, the esteemed CEO of Ithmar Capital. Concurrently, the United Arab Emirates' capital, Abu Dhabi, has been selected to host the 17th Annual Forum in 2025, whilst Greece emerges victorious in securing the rights to host the 18th Annual Meeting in 2026, following a unanimous decision by the membership.

In a unique homage to the cultural heritage of Oman, the Omani "Mandoos" (a traditional chest) has been chosen as the source of inspiration for the logo of the event. The Mandoos, deeply ingrained in Omani heritage, has traditionally been utilized by Omanis for the securekeeping of their most valuable assets, including monetary funds, jewelry, and other precious goods. This symbol of trust and emotional connection signifies the meticulous preservation and security of wealth, which aligns closely with the principles guiding sovereign wealth funds.

Furthermore, this choice underscores Oman's investment philosophy, focused on sustainable development and the preservation of wealth, while also highlighting the country's strategic coastal position as a hub for international investors. To commemorate this significant event, the Omani Investment Authority has released a commemorative coin in collaboration with the Central Bank of Oman. This coin celebrates the essence of authentic Arab art and the maritime history of Oman. Its design pays homage to key elements of Oman's cultural legacy, including the Khor Rori port in Samharam, the Dhofar Governorate, a principal ancient trading center, the renowned frankincense tree, valued for its aromatic resin on a global scale, the Ghanja vessel, emblematic of Oman's historical naval strength, and Muscat City, a symbol of Oman's historical importance. Additionally, the coin features intricate engravings inspired by Omani motifs, such as those from the traditional Mandoos and the Omani Khanjar belt.

This initiative marks the first commemorative coin issued by the Central Bank of Oman in the last four years and the inaugural coin with a unique serial number, thus making it a rare and coveted collector's item. The coin serves as a unique memento for attendees of the event, encouraging further exploration of Oman's cultural treasures.

Additionally, a commemorative stamp dedicated to the event represents Oman's identity as a "land of opportunity," capturing the nation's warm hospitality. On the right side of the stamp is featured a traditional Omani door, symbolizing openness and welcome, while the meeting logo influenced by the Mandoos occupies the center. Below, notable cultural and historical landmarks such as the Al-Mirani Fort, the old port of Muscat, and the Badan vessel, emblematic of Oman's rich cultural, historical, and commercial heritage, are depicted. The base of the stamp highlights Omani frankincense, a vital part of Oman's ancient trade history, as frankincense was a principal commodity on the Incense Route. The left side of the artwork illustrates the country's promising economic sectors, in alignment with Vision 2040 and the strategic direction of Oman Investment Authority.

The Alila Jabal Akhdar Resort stands as a beacon of tourism, while the presence of wind and solar power stations, a hydrogen energy project, the Oman LNG Company, and OQ underscore the diversity of the energy sectors represented. Meanwhile, the Salalah Port serves as a testament to Oman's emphasis on logistics and supply chains.

The Oman Investment Authority has meticulously crafted an integrated experience for attendees, offering them a glimpse into Omani culture and history. The schedule is meticulously planned to include visits to historic and cultural landmarks, such as the Royal Opera House Muscat, the Old Muscat, Al-Mirani Fort, Nizwa, and the Oman Across Ages Museum.

In celebration of this momentous global event, the Oman Investment Authority has released a special edition of its quarterly bulletin, Enjaz & Eejaz. This edition features comprehensive coverage of the International Forum for Sustainable Development in the Arab Region (IFSDAR) in Muscat, delving into its history and objectives. Duncan Bonfield, the CEO of the forum, highlighted in an interview for this edition the exceptional commitment of Muscat to the IFSWF Annual Meeting, emphasizing the creation of a conducive environment for members to exchange insights on critical issues and foster long-term relationships between investors and recipient countries. The special edition also sheds light on the Oman Investment Authority's collaboration with the IFSWF, provides details on various attractions in Oman, and showcases the Authority's investment portfolios.

In its endeavor to ensure the success of this pivotal event, the Oman Investment Authority has forged partnerships with a multitude of government and private entities. These key hosting partners include the Ministry of Heritage and Tourism, Oman Investment Bank, Omran Group, ASYAD Group, Omantel, OMINVEST, OQ, Hydrom, and ITHCA, among others. Additionally, the Authority has collaborated with the Office of the Governor of Al-Dakhiliyah, Oman Across Ages Museum, Royal Oman Police, Ministry of Health, the Royal Opera House Muscat, the Central Bank of Oman, and the Royal Guard of Oman.