New Delhi: In a continuation of its policy trajectory towards monetary easing, the US Federal Reserve has reduced its policy interest rate by 25 basis points, underscoring its commitment to maintaining economic stability.

The Federal Open Market Committee (FOMC) has, in its latest decision, set the target range for the federal funds rate at 4.5 to 4.75 percent.

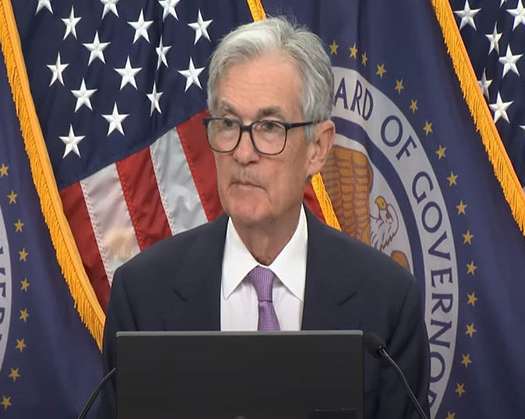

According to Jerome Powell, the Chair of the Federal Reserve, this adjustment reflects the central bank's resolve to promote sustainable economic growth and steer inflation closer to its long-term objective of 2 percent.

Powell stated, "Today, the FOMC has taken another step towards easing policy by reducing our policy interest rate by a quarter of a percentage point."

He further noted, "We remain confident that with an appropriate adjustment of our policy stance, we can sustain strength in the economy and labor market, while ensuring inflation moves steadily towards our 2 percent target."

The decision to lower the policy interest rate was made in light of recent economic indicators, which show robust economic growth, albeit with a slightly moderated pace in labor market conditions.

Although there has been a modest increase in the unemployment rate, it remains relatively low, indicating a robust job market. Inflation, although on the rise, has not yet achieved the Federal Reserve's target, highlighting the delicate balance the central bank is maintaining in its monetary policy adjustments.

The Committee underscored its focus on achieving full employment and stable, low inflation in the long term.

Acknowledging the uncertainties in the economic outlook and potential risks to both employment and inflation objectives, the FOMC emphasized the importance of closely monitoring incoming data, with a particular focus on labor markets, inflationary pressures, and international developments.

Looking ahead, the FOMC indicated a cautious approach towards further adjustments to the federal funds rate, taking into account evolving economic conditions and potential risks to its dual mandate.

The Committee reaffirmed its commitment to reducing inflation back to 2 percent and supporting maximum employment, stating its readiness to modify policy measures as necessary to maintain progress.

In alignment with these objectives, the Federal Reserve will continue to reduce its holdings of Treasury securities, agency debt, and mortgage-backed securities as part of its strategy to gradually reduce its balance sheet.

As the economic outlook in the United States remains multifaceted, Powell highlighted the Federal Reserve's vigilance towards a broad spectrum of factors. The Committee's decisions will be informed by data on employment and inflation, alongside assessments of global financial and economic conditions.

The latest reduction in the Federal Reserve's policy interest rate further solidifies its flexible and cautious stance as it endeavors to nurture a resilient U.S. economy amidst an evolving economic landscape.