New Delhi: According to the Global Trade Research Initiative's (GTRI) most recent analysis, India's goods imports are trending downward in June 2025, owing to reduced gold and crude oil shipments; nevertheless, exports remained steady.

According to trade data for June 2025 released by the Commerce Ministry on Tuesday, goods exports totaled USD 35.14 billion, a minor increase of 0.05 percent over June 2024.

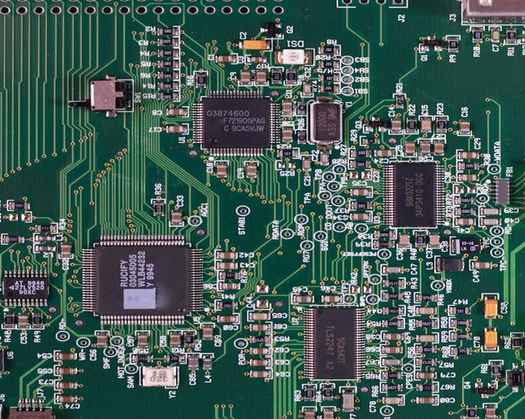

However, important industries like as electronics exports increased by 47.1% to $2.8 billion, indicating that iPhone and smartphone shipments to important markets, such as the United States, increased in advance of anticipated higher US tariffs.

However, owing to diminished global demand and cheap crude prices, traditional exports such as gems and jewelry fell by 20.4 percent to USD 1.78 billion, while petroleum product exports decreased by 15.9 percent to USD 4.6 billion.

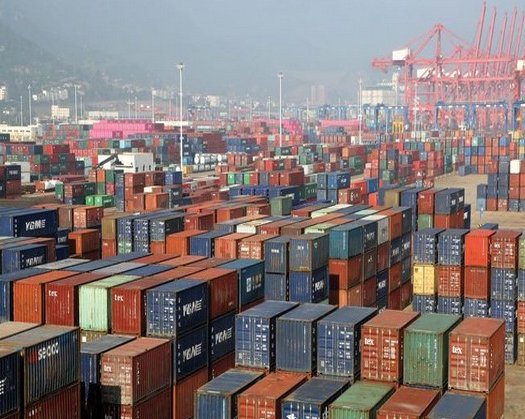

On the import front, total commodities imports were USD 53. 9 billion, a 3. 7% decrease from the previous year. This drop is mostly driven by a significant 25. % decrease in gold imports, which fell to USD 7.5 billion, as well as an 8. 4% reduction in crude and petroleum imports, totaling USD 13.8 billion. Coal and coke imports fell by 19.1 percent to USD 7.75 billion, owing to increased local production.

Electronics imports climbed by 9.5% to $8.4 billion, while machine and computer imports increased by 8.5% to $4.4 billion. This indicates that domestic investment in assembly and production remains strong.

Exports to the United States increased 23.5% to USD 8.3 billion, confirming America's position as India's greatest export destination. In comparison, exports to China were low at USD 1.4 billion, albeit they increased by 17.2% year-on-year.

India's imports from China amounted at USD 9.5 billion in June, a 2.5% rise over June 2023.

The commerce data for June 2025 reveal indications of a continuing structural shift in India's export portfolio. High import intensity industries, such as technology, are growing, whereas traditional labour-intensive industries remain flat or decline.